It is now well-known that Venezuela is currently sliding through a hyperinflationary maelstrom from which there is no easy way out. The banknotes that were introduced in 2007 are now beyond worthless; they’ve become nothing more but a collector’s item. All of our coins are better off being smelted and their metal repurposed into something of value.

The new 2016-2017 series of banknotes were hastily announced a year ago to alleviate the situation, but even at the time of their announcement they were just like throwing a bucket of water at a raging fire.

ATMs here will have two states: Empty or Full; if you don’t see a single soul nearby it then it means it has no cash to dispense.

If you see a crowded one then your pilgrimage has paid off, there’s money to be withdrawn! Better start praying that it still has something by the time its your turn.

But even after you’ve done your long queue the machine will only dispense 10,000 Bolivars per day, per account; this amount is no longer enough to buy a single loaf of bread, if you want more you better have another account, and if it’s from another bank well—get ready for another adventure.

Even though these banknotes hold no real acquisitive value, they hold an intrinsic value, a value of time and effort required to obtain a decent amount of them; there are some things you can’t pay with anything else, such as bus rides, parking fares, gasoline. Having “Sencillo” (spare change) as difficult as it’s become to obtain, doesn’t hurt.

There are clandestine but hidden in plain sight places where they will swipe your debit card for a determined amount, and after a hefty commission surcharge (which can sometimes be 50%) you’ll get your amount in paper currency.

We’re thankfully not (yet) at Weimar levels of hyperinflation—then again, there isn’t enough paper cash in circulation to emulate that era.

Being severely cash-strapped, Venezuelans have moved onto other forms of payment in order to purchase goods and services, because let’s face it, it sure beats doing an ATM line for only 10,000 Bolivars.

Debit Cards

The now de-facto preferred form of payment here, the engine that runs what’s left of this broken economy. A blessing that can often turn into a curse. The banking infrastructure is ill-prepared for the massive surge in transaction traffic.

Transactions can, and will often fail, in many cases they time out due to network congestion, or take a few minutes to process; this prolongs your queue times in any place, especially during peak hours, holidays, and around the 15th or 30th of every month (where the large majority receives their wages.)

Sometimes, a specific bank’s cards will not go through due to problems in their systems or due to high congestion, if you don’t have another form of payment, namely, a debit card from another bank, or a credit card that can cover the costs then you’re out of luck.

Stores largely depend on these devices, if they lose connection or worse, malfunction, then their daily sales will suffer, not everyone will pay you with cash; street hot-dog stands that have one of these will always have an advantage against those that do not, it is not uncommon to see informal sellers on the streets with their own device.

Obtaining one of these for your business has become difficult—unless you pay a hefty amount of cash to the right person.

Credit Cards

For some, credit card used to be for leisure expenses, to pay for postpaid cellphone or cable tv subscriptions—a status symbol, if you will. But nowadays, it can make all the difference in the world.

Not everyone has a credit card these days, hell, a large portion of our citizens do not even have a bank account; the credit limits that once could consider ‘generous’ in the past have rapidly been devoured by hyperinflation.

The average credit card spending limit for a regular credit card is currently at 100-300k Bolivars. To put it in perspective, two pork chops are nearly Bs.100,000.

Truth be told, credit card interest rates here are quite low, so credit cards will definitely get you out of a hurry more often than you can think.

Bank Transfers

Ah, Internet Banking in Venezuela, the only way to pay stuff when debit cards are out of the question. Paying your utility bills through this way is a godsend timesaver in a country plagued with long queues and waiting lines. I still remember the huge lines that I had to make a decade ago to pay for our internet and electricity bills, they’re now a thing of the past.

However, bank transfers are not without their fair share of contrivances, transferring money to another account from the same bank will always be instant, transfers to an account in a different bank will go through in the afternoon if you did it before 9-10am, otherwise they’ll go through in the next working day (no weekends.), Banks had enough and implemented absurdly large transfer limits so they don’t have to constantly update the caps to keep up with hyperinflation.

On the plus side, banks here have their own smartphone apps for iOS and Android devices, if you’ve previously registered a bank account via desktop, or a service, you can easily do your transactions with these. Unfortunately, these apps have limited compatibility with old phones; which, in a country where pretty much no one can afford a new phone, severely limits their usage.

The overall experience varies by bank, either it works, or it doesn’t, with some being worse than another, and they’re all subject to our collapsed internet services. Here’s some examples that I’ve had the displeasure of using:

Banesco (Privately owned):

This is by far, the best one I’ve used, it’s also the only bank I have an account with, the whole thing is fast, efficient, and is rarely unavailable, their UI, while far from perfect, is easy enough to use for your average user.

Their two-factor authentication involves security questions when logging from a new computer, and a “special operations” sms required to add new accounts into your directory. A “pick an icon” from a randomized pool verification step was recently phased out.

Mercantil (Privately owned):

Almost as good as Banesco’s but not quite, unlike Banesco, they employ a grid-based two factor authentication “coordinates card”. The user interface is a bit cumbersome, but manageable; they also allow you to setup your own transfer caps to specific people, but with hyperinflation kicking our butts in full force you might as well don’t.

Banco del Tesoro (government owned):

Of all the Government-owned banks, their website is the best out of the bunch, it makes use of a grid-based two factor authentication and an sms code to secure their operations. I don’t have much to complain on this one other than the fact that their UI can be a bit unfriendly to those less tech-savvy.

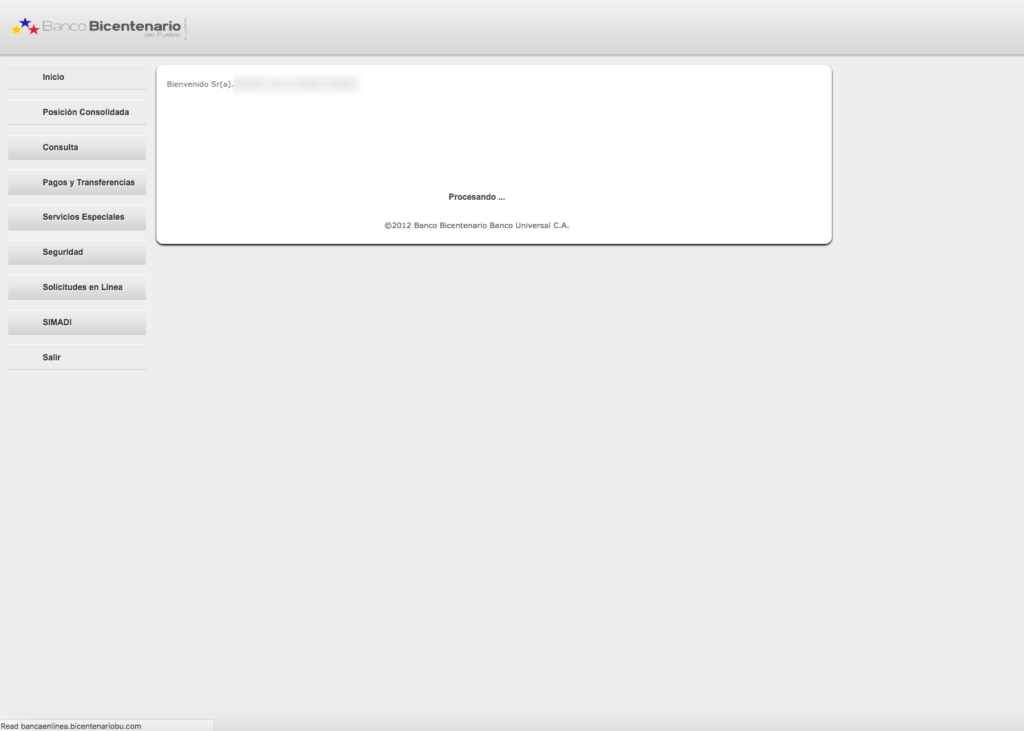

Banco Bicentenario del Pueblo (Government owned):

This one’s a special case, its where my mother receives her pension. For reasons I cannot understand or comprehend, this website’s login will only work for me through Firefox, even though they advertise compatibility with Google Chrome and Microsoft Edge—I’ve even tried different computers and OS to no avail, its Firefox or bust.

“This website is slow” is a huge understatement, I’ve measured it sometimes and it can load as slow as 5Kb/s. Sometimes it can be so slow that by the time its loading you’ll instantly get a “Session timed out due to inactivity.” Message, and you’re back to step one.

In fact, it’s so astoundingly slow that as soon as my mother gets her pension I try my best to transfer it outta there and into another bank account of hers just so she doesn’t have to deal with this bullshit. A decent user interface is useless if it never loads.

Banco de Venezuela (Government expropriated):

This is, by far, the worst web banking you can possibly do in this world, whoever designed this crap hates humanity and wants to see it suffer.

To begin with, if you try to login using Linux, OSX, or any other OS, it will ask you to install a “verification” plugin; I don’t know about you all, but I sure as hell will never trust any piece of software that comes from the Venezuelan Government (or any Government for that matter), especially when it’s closed source. I don’t even login to this website using my desktop computer.

The UI is borderline atrocious and so bloated that it makes my World of Warcraft user interface look clean in comparison, and if that wasn’t enough, this bank’s two-factor authentication is overkill.

If you want to register a new account to transfer funds to, it’ll first send you a password via sms that has a high chance of never arriving in time; secondly, it’ll ask you to input a set of numbers and letters from a grid-based coordinates card (activating one of these another odyssey), and then it’ll ask you to answer your security question, there’s also a time limit to these operations, one that ignores the slow load times that you’ll often experience.

There are plenty more government-owned and private banks in this country, but the above-mentioned examples are some of the most widely used.

Phone Banking

Don’t, just don’t.

Special mention to Banco de Venezuela, you have better chances at the lottery than trying to get through their phone banking. 99.9999999% of the time you’ll be greeted by the busy line tone.

Inter-banking payment apps.

This one is a new solution, implemented by the Bank authorities in conjunction with the country’s banks.

Every bank is now implementing their own version of these new and separate smartphone applications that seek to simplify bank transfers by reducing the amount of information required for a regular wire transfer (namely, the really long bank account number nomenclature we use, and instead only requires the receiver’s name, ID number and Bank Name.)

This solution is still not a widespread one, but it looks promising. However, its reach is limited to the fact that not everyone has a compatible phone, and it requires that you previously sign up with your bank to receive or send funds through this nascent network.

Bartering

If all else fails or you just don’t have the money owed, just trade stuff with your friends and family. Trading hard to obtain items such as flour, sugar, toiletries, rice (and now, meat and chicken) for something else is common practice.

Our economy is comatose and dying, not everyone can even afford to feed themselves, but you still gota pay for stuff somehow, you still gotta survive…